Sustainability in the financial sector: hype or hope? This was the topic of the fifth VersicherungswirtschaftCLUB in Karlsruhe. The industry managers are grappling with regulatory measures that are counterproductive in some cases. Above all, however, they offer constructive solutions and send a positive signal that they want to be part of the change to a greener world. According to the top-class panel of experts, companies that do not do so are threatened with extinction.

Sustainability in the financial sector: hype or hope?

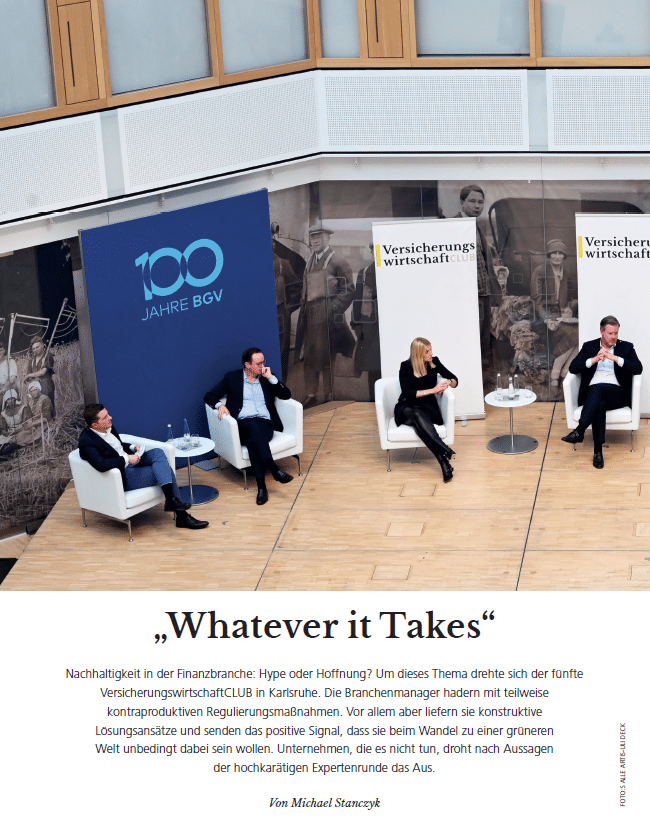

Alongside Gothaer boss Oliver Schöller and Zurich board member Claudia Max, Ralph Hientzsch, managing partner of Consileon, took part in the fifth VersicherungswirtschaftCLUB in Karlsruhe on the currently very relevant topic of sustainability. His central statement: “A comprehensive strategy that shows the dependencies is missing in the companies” was at the core of the discussion.

This revolved around the noticeable effects of the climate crisis and how insurance companies can make their contribution to a sustainable future. Sustainability, the biggest social transformation of the last 150 years, can only be mastered if the individual points are tied into a clever plan. “Sustainability is a matter for the boss, it must be a CEO task,” emphasised Ralph Hientzsch to the agreement of the other participants. The industry managers, however, are struggling with partly counterproductive regulatory measures. Ralph Hientzsch noted that there is often too much regulatory talk and that the topic diffuses away from the CEO.

Miss Finanz” Katharina Karageorgos knows how sustainability is received by customers: “Many don’t know that you can invest sustainably in many things, such as old-age provision”. Ralph Hientzsch noted in this context that sustainability and returns are not contradictory. “This should encourage us to talk to our customers. Good solutions are “always in demand”, he emphasised. The panel agreed that the intermediaries have a duty here.

The participants also agreed that there is no alternative to sustainability. Insurance companies that “don’t want to afford it” will no longer have a raison d’être in the future, Oliver Schöller emphasised. Ralph Hientzsch made it clear in this context that the cost issue will lead to differentiation in the market. Courageous companies will gain a strategic advantage and get the chance to reposition themselves: “A mega opportunity”.

All in all, the panel provided constructive approaches to solutions and sent a positive signal that the insurance industry is determined to be part of the change to a greener world. Details on the fifth VersicherungswirtschaftCLUB can be found in the current June issue of Versicherungswirtschaft, which you can download here as a special edition (this article is in German).