Range

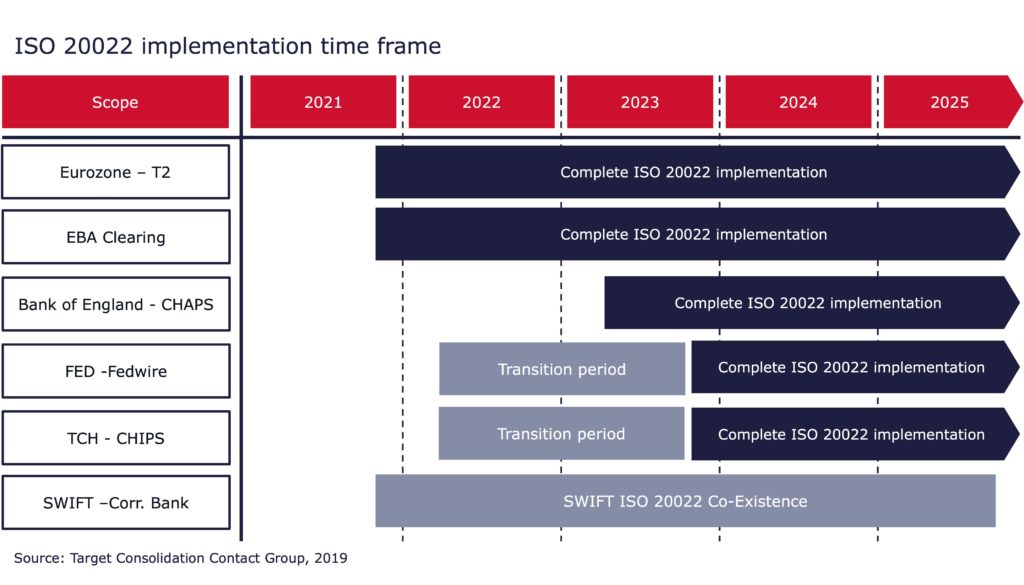

In the course of the technical and functional consolidation of the Target2 payment transaction system (T2) with the Target2-Securities (T2S) securities settlement platform, the central banks of the Eurozone (Eurosystem) will gradually introduce the ISO 20022 message standard over the next few years. Adapting to this standard will be a mammoth task for banks. A key point is the conversion of payment traffic messages from SWIFT formats (message types, MT) to XML. The long-term goal is global convergence of message standards.

Credit institutions should take this reform very seriously. Those who miss the deadlines here will literally lose out. After the changeover, it will no longer be possible to communicate with Target2 in the old formats, and the link to the ECB will be severed. As a result, defaulting institutions will not only cut themselves off from interbank clearing and from their minimum deposits, but also from favorable refinancing with the central bank. What seems to be bearable and negligible in the acute low-interest phase will take its revenge as soon as the ECB raises the key interest rate. The Swedish Riksbank has just raised its key interest rate.

In any case, the Eurosystem is one of the laggards in the switch to the XML message format. Pioneers such as the Bank of England, the Fed, the Swiss National Bank and the Japanese central bank have been making the switch for years.

Scope and schedule

In addition to format conversion, T2-T2S convergence includes the following measures:

- Introduction of a real-time gross clearing system to consolidate the two systems technically and functionally and to improve services

- Separation of central bank operations from real-time gross settlement (RTGS) between institutions.

- Introduction of central liquidity management (CLM)

- common reference data management (CRDM)

- standardized invoicing

The changeover of the message format initially affects payment transactions with customers (MT1xx) and banks (MT2xx) as well as cash management and customer data (MT9xx).

Although other players such as SWIFT have postponed their releases because of Corona, the ECB is sticking to its schedule. According to this, T2 and T2S will be technically consolidated on November 22, 2021. After the “big bang,” credit institutions will have to comply with the new standard. The ECB has explicitly ruled out a transition period in which the old and new formats coexist.

Approaches

Non-adapted systems, for example in payment transactions, cannot process the XML format. Each institution should therefore take stock as quickly as possible, determine its need for action and find a customized solution. We see three options here:

- Reprogram all systems and processes involved to the new format.

- Use a converter that translates between the formats

- Delegate payment transactions to external partner

Each of these solutions has its advantages and disadvantages. Even if options 2 and 3 have less impact on day-to-day business in the short term, banks should not underestimate the effort involved in T2-T2S consolidation including ISO 20022 conversion.

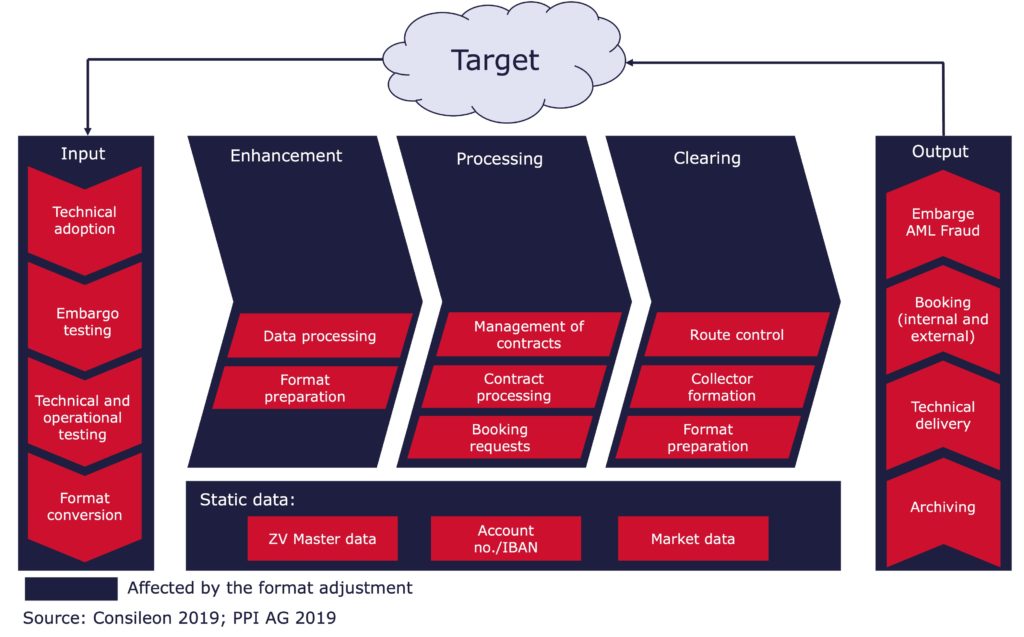

Option 1: Adaptation of the systems

Payment messages are processed in a number of systems in banks, including account information systems, e-banking, technical archives and liquidity management. These legacy systems still operate with SWIFT messages, among other things. Urgent cross-border transfers occur not only in regular payment transactions, but also in trade finance and securities business. In addition, interoperability with anti-money laundering (AML) software and embargo checking systems must be ensured.

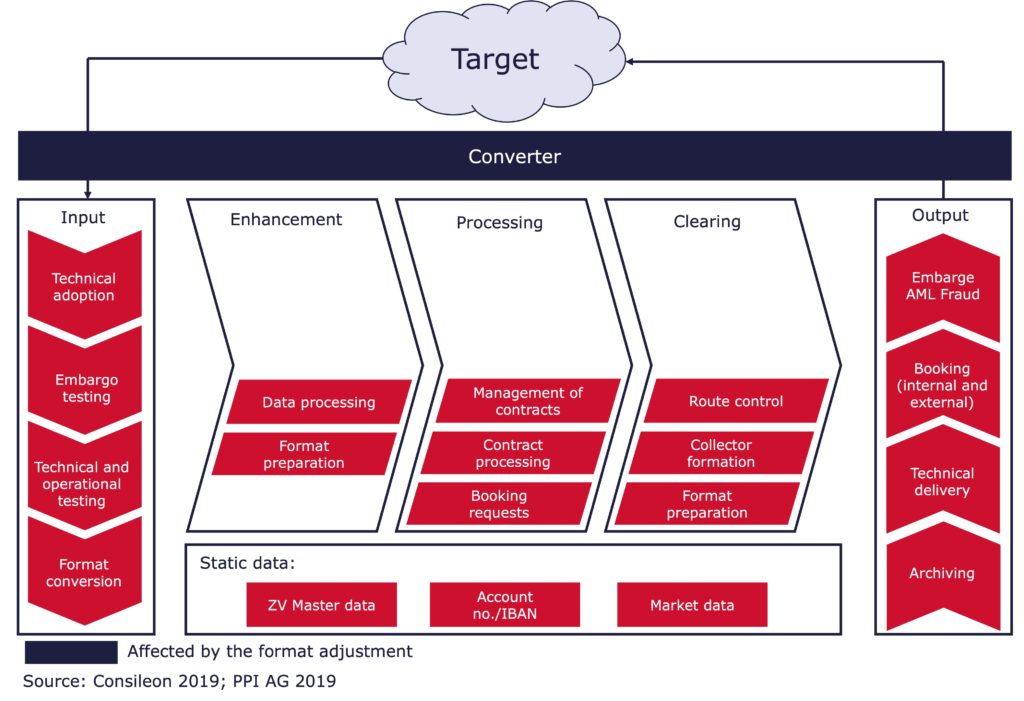

Option 2: Converter

When using a converter, the legacy systems continue to work as before. The program converts incoming messages into the old format. After processing, it formats the output into XML. There are three cases to distinguish in this procedure:

- Die Auswahl

- The selection of data fields of the incoming message differs from the internal layout

- Incoming messages contain fields that do not yet exist internally

- Incoming message fields contain more characters than the internal counterpart accommodates

To ensure that information is not lost in any of the three cases, the data fields of the incoming messages must be mapped to the internal model in advance. Overlong or new content is distributed to several fields of the internal model. If necessary, new fields are to be created. For new information that cannot be integrated into the internal data model, alternative further processing or at least archiving must be programmed. Special attention must be paid to outputs that are sent to customers, such as account statements, or that are forwarded to other institutions.

Because the data models and processes vary from institute to institute, there is no patent remedy for the use of a converter. For this reason, those responsible at the institute must analyze and regulate the three use cases in advance together with the developers and test them again and again during the course of the project

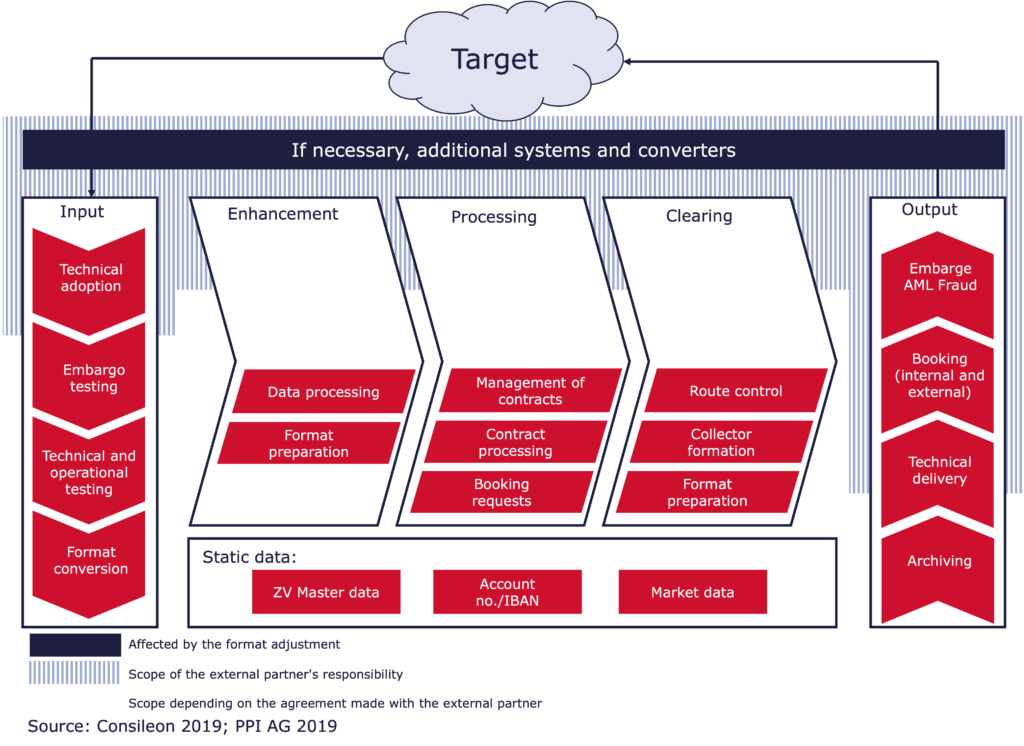

Option 3: Outsourcing

Anyone wishing to outsource payment transactions must first decide which work steps the external partner should take over. This raises similar technical questions to those relating to the use of converters. The outsourcing solution must also prevent any conceivable disruption to the flow of information. In consultation with the service provider, it must be clarified how the incoming data will enter the processing systems and how the output will be sent.

One sticking point is the external processing of orders in which the institute acts as an intermediary between several parties. If deficiencies in the outsourcing solution result in information being lost along the way, third parties may be harmed.

In the case of outsourcing, too, much depends on the circumstances at the client. For this reason, there is no standard solution here, just as there is no standard solution for options 1 and 2.

Our advice

As there is no way around ISO 20022 in the long term, we recommend adapting all systems by the deadline. The new message format will become the world standard. If you want to be able to process incoming and outgoing data for payment transactions as quickly and error-free as possible in the future, you would be well advised to convert to XML messages. If time is of the essence, a converter will help you to remain capable of acting in the short term. Above all, when working out the requirements for this solution, banks gain valuable insights into their IT architecture, which they can draw on when adapting their systems natively at a later date.

Consileon provides advice and support for T2-T2S consolidation projects including ISO 20022 implementation – from evaluating options to designing processes and services.