How artificial intelligence can revolutionize banks’ fight against money laundering in the future

In our study, which is cited several times in a detailed article in the Handelsblatt of January 18, 2021, we show you why AI in particular can revolutionize banks‘ efforts to combat money laundering in the future.

The problem is more topical, the criminal energy more creative than ever: money laundering scandals have recently rocked quite a few banks in Europe and in this country. As a result of globalization and digitalization, financial institutions are facing increasingly complex fraud schemes – with far-reaching consequences in terms of fines and reputational damage. Banks have a duty to prevent money laundering and are required to take targeted action to counter the abuse of the financial system. However, they face many different challenges in doing so:

- Increasing number of global transactions every day

- New, more complex fraud opportunities due to globalization and digitalization

- Increasing due diligence requirements for banks

- Predominantly manual processes and a mostly outdated technical infrastructure

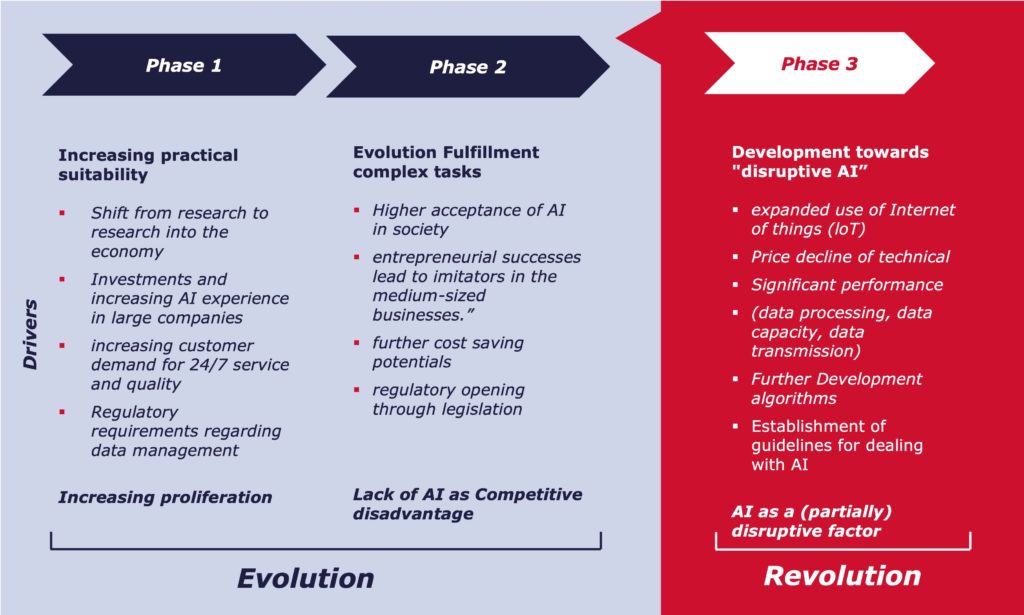

In particular, we see enormous potential for generating important competitive advantages in the further accelerating digital transformation as well as in the implementation of novel key technologies such as artificial intelligence (AI). In order to be able to make concrete statements about the actual performance capacity for combating money laundering from a temporal and functional perspective, despite the fast-moving and dynamic development in the topic of AI, Consileon has developed a future-oriented, three-stage phase model.