Quo Vadis?

We are currently in the midst of the greatest upheaval in individual mobility since the introduction of the automobile. Everyone is talking about the automotive transition and new mobility offerings: E-scooters are one form of this.

There is uncertainty about the future role of e-scooters with regard to the new mobility. There is a split picture – while some see it as the savior for the last mile, others see it as just another failed attempt in the field of e-mobility.

E-scooters are designed for short-distance use and are intended to serve the first or last mile. They typically cover distances of between 500 m and 4 km – without the need to sweat or search for a parking space. The providers pursue a sharing principle in which the scooters can be rented for a fee (from unlocking: time and distance) via app and mobile payment.

Worldwide, e-scooters have been present in many cities since 2017. In Germany, however, the e-scooters were not approved until June 2019, but then changed the cityscape overnight.

The objective of e-scooters sounds thoroughly positive at first:

- Reduction of traffic volume

- Solution of the (parking) space problem

- Reduction of CO2 emissions

- Minimize air and noise pollution

- Alternative to the car / motorcycle

- Overcoming the last mile

- Connection of mobility hubs

However, the problem is that e-scooters mostly replace pedestrian or bicycle traffic, instead of car or motorcycle traffic. This is bad for both the environment and health. The German Federal Environment Agency has evaluated the environmental friendliness and concluded that the scooters tend to bring disadvantages for the environment in inner cities where public transport is well developed. They also make bicycling or walking less attractive.

Another major problem is charging the scooters. The so-called “juicers” drive many kilometers in vans to collect the electric scooters, usually overnight.

Recently, a scandal broke out when resourceful students came up with a lucrative business idea: “juicers” as a side job. The scooters were charged overnight in the apartments of the University Center of the University of Cologne. The trick: the students only pay a flat rate for incidental costs, which is why the sharp rise in electricity costs caused such a stir at the student union.

Currently, the suppliers of e-scooters tend to burn money. The scooters currently have a service life of three months, whereas a break-even point is only reached at a service life of around four months. However, this does not take into account any marketing or overhead costs.

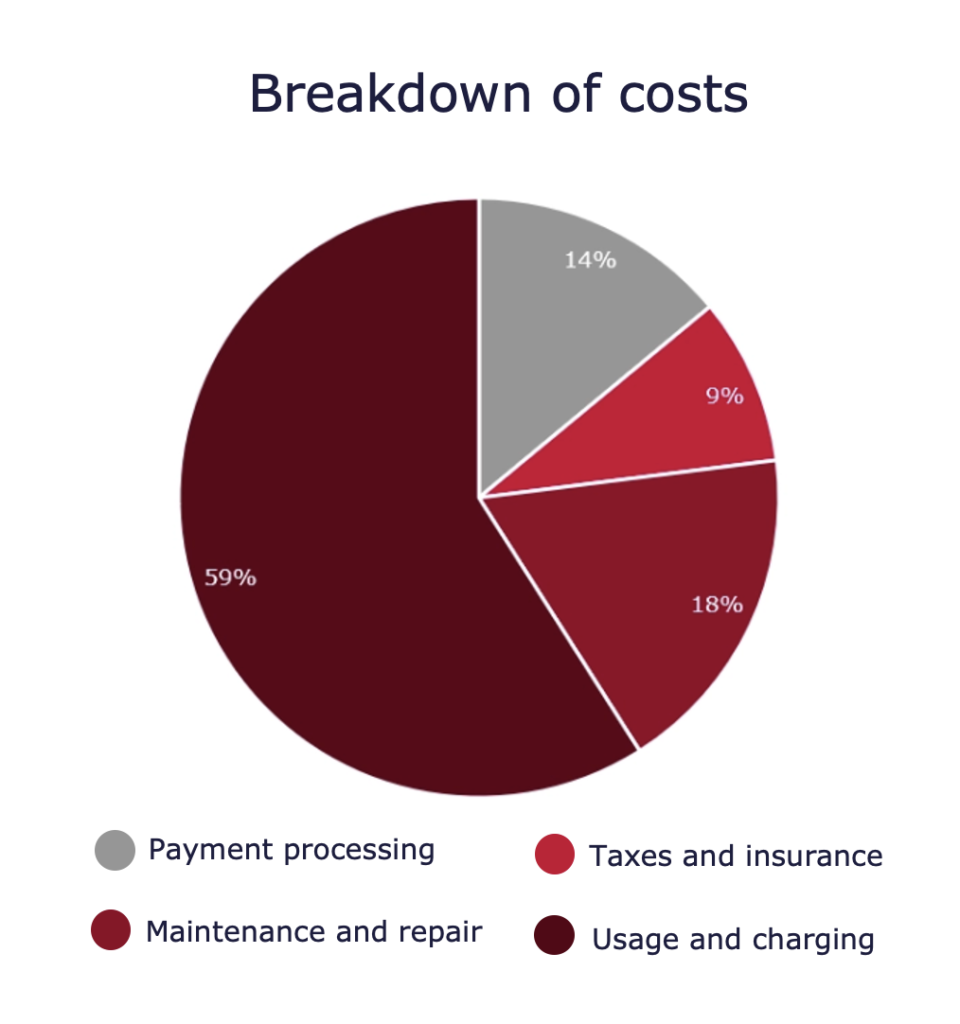

Looking at the cost side of the scooters, they can be grouped into four blocks:

- Payment processing costs

- Taxes and insurance

- Maintenance and repair

- Operation and loading

It is noticeable that the highest costs are caused by charging.

“Juicers” have to go to great lengths to collect the scooters, plug them in overnight and deliver them again. To reduce costs, so-called crowd-charging models are also being tested, where users can take the scooter home to recharge it there.

Of course, vendors are trying to make further improvements to the hardware to reduce costs accordingly. Some providers are trying to develop their own hardware that has a longer lifespan. In addition, the providers are also planning to use exchange batteries.

Below is a brief overview of the largest e-scooter providers:

Lime

| General facts | Markets supplied | Unique Features |

| Founded in 2017 in San Mateo, California (USA) | USA, Canada, Mexico, Australia, New Zealand, Singapore and nine European countries | Support by Google Maps |

| Approx. 700 employees (before Covid) | 15 German cities | Charging with renewable energy |

| 467 million dollars investment | ||

| 25,000 scooters in Germany | ||

| 1,065,000 downloads in the German Google Play Store from May 2018 – May 2020 |

Tier

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Berlin, Germany | 57 cities in 11 countries | Innovations such as foldable helmet and transport box |

| Approx. 470 employees (before Covid) | 39 German cities | Replaceable batteries in planning |

| $31 million investment | Climate-neutral operation from 2020 | |

| 18,000 scooters in Germany, 40,000 worldwide |

voi

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Sweden | in the German cities: Aachen, Augsburg, Berlin, Bremen, Düsseldorf, Erfurt, Hamburg, Ingolstadt, Karlsruhe, Lübeck, Munich, Nuremberg, Potsdam and Stuttgart. | Replaceable battery |

| Approx. 500+ employees (before Covid) | 8 weitere, europäische Länder | Display that shows parking zones |

| $53 million investment | ||

| Several hundred scooters per city |

BIRD

| General facts | Markets supplied | Unique Features |

| Founded in 2018 in Santa Monica, California (USA) | North America, Europe, Middle East | Longer durability of the scooters |

| Approx. 1,300 employees (before Corona) | 22 European and 5 German cities | High range thanks to strong battery |

| $415 million investment | 81 cities worldwide | |

| 100,000 scooters worldwide | ||

| 103,600 downloads in the German Google Play Store from May 2018 – May 2020 |

circ

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Berlin, Germany | Berlin, Cologne, Hamburg, Frankfurt, Munich | Design of 4-wheeled micromobiles for 2 persons |

| Approx. 100 employees (before Covid) | Austria, Italy, Spain, France, Belgium, Denmark, Portugal and Switzerland | Replaceable batteries in planning |

| 55+ million dollars investment | European expansion plans | |

| 20,000+ scooters across Europe | ||

| Bird subsidiary |

The low level of differentiation among suppliers leads to problems. Consumers generally simply opt for the scooter that is available next. It is questionable whether the diversity of providers will continue in the future. Providers will fight for individual cities. To do so, they will have to guarantee high availability and offer a larger operating radius. However, this will come at a price: lower utilization per e-scooter and thus higher costs.

It is very likely that the market will consolidate in the end and that only a few large providers will survive. It remains questionable whether regional providers will be able to stand up to large companies in individual cities.

E-scooter providers must continue to work on their business model in order to survive in the long term. The following steps are necessary for this:

- Further efficiency improvements in the operation of the e-scooter fleet

- Expanding the durability of the scooters and thus ensuring a longer-term useful life per e-scooter

- Pursuing an aggressive growth strategy in order to survive

- Securing financing for the business model

Whether e-scooters will continue to shape the urban landscape to the current extent remains to be seen. What is certain is that the scooters can play an important role in urban transportation.