Disclaimer: The generic masculine chosen in this article refers simultaneously to male, female and other gender identities.

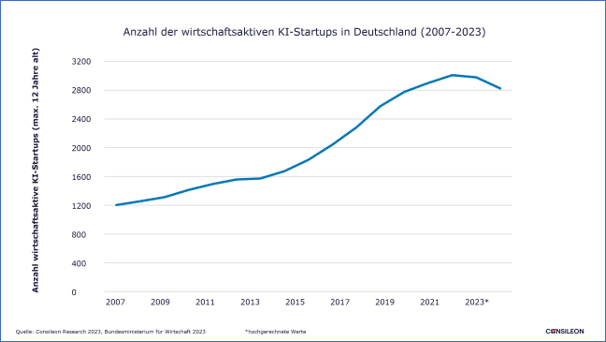

In recent years, artificial intelligence (AI) has established itself as a disruptive technology that influences all sectors of the economy. The number of commercially active AI start-ups has increased significantly over the past 15 years, from around 1,200 in 2007 to around 3,000 in 2021, with a slight decline shown in 2022 and 2023. This is due, among other things, to an increased number of market exits in the economically difficult years of the Corona pandemic and the economic slowdown in 2022.

In the financial sector in particular, AI has already found a wide range of applications. A number of banks are already successfully using artificial intelligence to improve their services. Of 335 new AI start-ups founded in 2022, approximately 65-70 are in the financial and legal services sector (equivalent to around 20 per cent). [1]

But what can these technologies currently achieve in concrete terms and where do banks need to start for successful implementation? What do customers expect today and which technical solutions meet these expectations?

We highlight the importance of AI to improve the customer experience in the financial sector; in particular using banks as an example. We discuss both current trends and the resulting benefits, and define the necessary prerequisites for banks to successfully use AI for an optimised customer experience. Finally, a holistic approach is demonstrated that enables institutions to position themselves competitively with state-of-the-art technologies and successfully position themselves on the market in the long term.

I. Current, technological trends to improve the customer experience

The financial sector has developed a variety of AI applications to improve the customer experience. These take on various functions from the front to the back office to optimise banking processes. Harnessing these opportunities is not entirely new. However, banks that do not strategically address the use of AI in their business model risk losing out and being left behind by the competition.

With the help of technology, procedural trends are emerging that improve customer service and relieve counsellors.

Virtual assistants to reduce the administrative burden

Banks are increasingly using chatbots in their customer service departments. Providers in banking who use bots can expect to save an average of just over four minutes per enquiry, which corresponds to an average cost saving in the range of €0.45 to €0.65 per interaction. [2] These AI-driven programmes can process customer requests and even carry out complex transactions. By using Natural Language Processing (NLP), chatbots can mimic human-like interactions; they can support customers around the clock as well as relieve the back office by recognising and scanning documents. Currently, the most prominent example is the NLP bot ChatGPT , which can be linked to the bank’s own systems via an API interface if required and thus trigger and accompany customer interactions at the same time. [3]

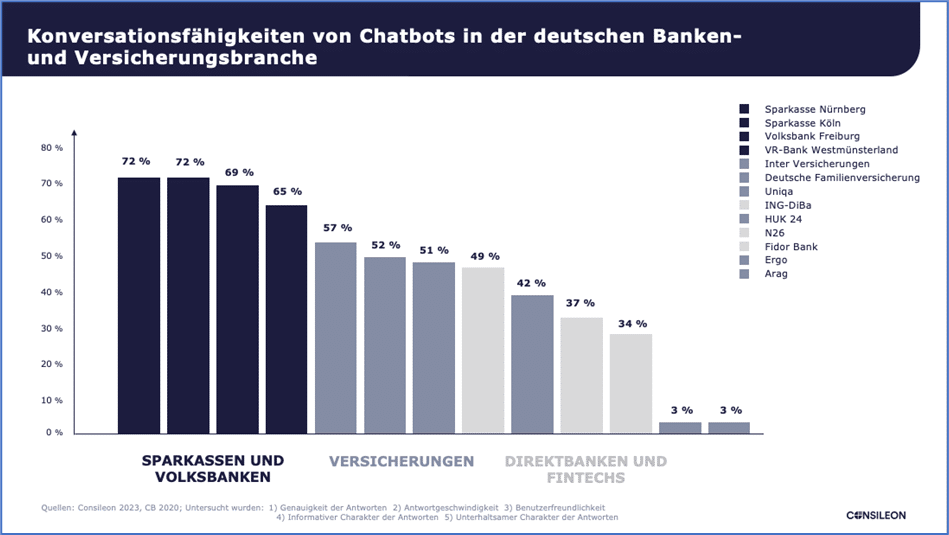

In Germany, the Sparkassen and Volksbanken in particular are convincing in their interaction with their customers, measured by the speed, accuracy and quality of their responses. However, chatbots are not a plug-and-play solution, but require dialogue processes devised and trained by users.

Another interesting aspect of using virtual assistants is the ability to analyse telephone recordings to develop appropriate topic suggestions for employees. By transcribing and analysing customer interactions, banks can gain valuable insights to improve advice and customer service. AI can extract important information and thus, for example, recognise frequently asked questions, concerns or trends in the behavioural patterns of customers. Consumers thus receive improved advice and support, which improves customer loyalty and satisfaction. [4]

One example of the use of these opportunities is the Unique FinanceGPT business model. Together with Unique’s ChatGPT-based solution, banks can define use cases to reduce the administrative burden, freeing up more time for relationship managers to provide personalised support to their customers. These use cases include automating CRM entries, collecting support information and writing meeting summaries. [5]

Natural Language Processing and customer-centric interactions

In addition to the reduction of administrative work already described, banks also use NLP and data analytics to offer personalised product and service recommendations. By analysing customer data and behaviour, algorithms can create targeted offers that meet customers’ needs and preferences. After all, around 50 percent of them expect personalised interactions from their bank. [6] By neglecting this need, banks risk losing part of their clientele to competitors and thus market share.

AI offers many opportunities to provide customers with personalised services based on their past usage patterns. The insights from this data can be used to understand their needs more precisely and encourage them to use the bank’s services more often. For example, if a customer uses a current or credit card to pay for a flight, an NLP bot can establish a dialogue in online banking and help suggest personalised offers, such as recommending cheap hotels or taxi rides. In addition to higher transcations, this in turn leads to greater customer satisfaction and loyalty.

Nordea Bank uses NLP models to improve the success rate of individual customer enquiries and thus provide personalised solutions. Nova, an NLP chatbot developed by the bank itself, has an average of more than 220,000 conversations per month with private banking customers in the Nordic countries. In terms of total customer interactions, the bank claims a success rate of 91 per cent for private banking customers and 95 per cent for corporate customers. [7]

But not only end customers benefit from the various technological approaches. Customer advisors also benefit from customised product suggestions through the data collected by NLP bots in the bank’s own CRM. In this way, targeted offers can be prepared and appointments made.

Transactional analysis and fraud prevention

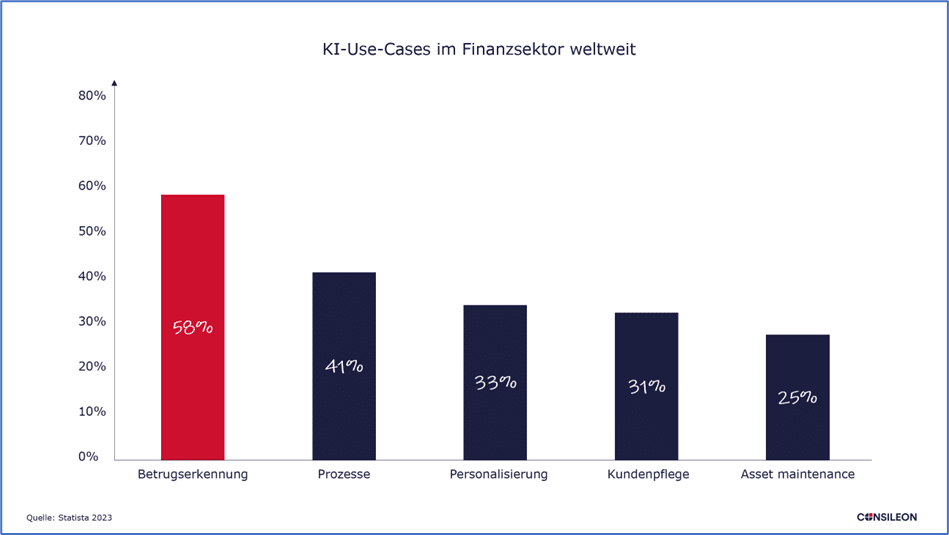

Artificial intelligence can help to detect unusual account transactions at an early stage. Worldwide, 58 percent of companies in the financial industry use AI to filter conspicuous transactions in order to detect fraud in time.

Citibank uses AI for fraud prevention. The US bank has integrated artificial intelligence into its security systems to detect fraudulent activities in real time. This can be, for example, unusual withdrawals from ATMs in other countries or atypical online purchases. The technology thus not only helps to minimise financial losses, but also strengthens customers’ confidence in the security of their financial transactions.

VISA has equipped the back office with the VISA Advanced Authorisations (VAA) risk management tool. An analysis of 127 billion payments over a one-year period showed that the system identified and subsequently prevented fraudulent transactions amounting to 25 billion US dollars. In addition to VAA and other tools, (real) people are also integrated into the multi-level prevention approach, resulting in VISA achieving a fraud rate of less than 0.1 per cent worldwide. [9]

II. The advantages of using AI

The above trends offer banks a number of advantages in improving the customer experience.

Proactive customer care

AI-supported systems analyse data in near real time and can react to certain patterns or changes at an early stage. This creates the opportunity to proactively address customer needs and act in time in case of potential problems or risks. For example, by using conversional bots in apps or their online banking portal, banks can inform customers about upcoming due dates for bills or credit card payments. Some financial institutions already use such systems and employ AI to notify customers when their account balance is low, allowing them to prevent overdrawing their account.

Personalised customer experience

By using NLP and data analytics, banks can analyse the behaviour, preferences and needs of homogeneous customer groups as well as individual customers. This enables banks to create personalised offers and recommendations. Bank customers are willing to share their data with smart devices and systems if their needs are better understood and served as a result. However, modern, personalised customer service goes far beyond simple product suggestions. The use of AI even makes it possible to develop personal financial plans as well as to support consumers in achieving their individual financial goals.

Efficient automation of processes

Technology can automate repetitive tasks and thus increase the efficiency of banking processes. These tasks are not limited to transactional analysis in fraud prevention. By automating application procedures and other routine processes, bank employees have more time for personal interaction with their customers. Consileon estimates that 32 to 36 per cent of companies in the financial market are already using robotic process automation (RPA) to automate repetitive tasks and achieve economies of scale for both customers and employees. Banks, for example, can use RPA to speed up a customer’s credit card processing by having a bot simultaneously run internal and external credit checks and then make a decision based on set parameters. [10]

III. Success factors for the use of AI in banks

For banks to use AI effectively, certain conditions must be met.

Data quality and accessibility

AI enables the analysis of large amounts of data. Banks need high-quality data in order to gain meaningful insights. The quality and management of big data is one of the biggest challenges for banks when implementing AI. The reason for this is often lock-in effects due to high investments in IT systems that do not meet the requirements for (nearly) real-time processing of data, as well as internal resistance in the organization.

Banks must ensure that their data is complete, up-to-date and free from distortions or errors. A solution to these challenges may be the use of data cleansing techniques and the introduction of data quality standards.

IT infrastructure and expertise

To successfully deploy AI, banks need an appropriate IT infrastructure and expertise. This includes powerful computing units, cloud computing skills and data science knowledge. Therefore, it is essential to invest in the modernization of your IT systems and to hire professionals with AI skills.

The availability of skilled workers with AI skills is one of the biggest challenges in implementing artificial intelligence. Banks should therefore invest in training and education programmes to equip their staff with the necessary skills. Employee retention and training are one of the most effective levers to meet the requirements of a tailor-made infrastructure. At the same time, companies benefit from internalized knowledge formation.

Data protection and security

The use of AI requires a high level of data protection and security. Banks must ensure that customer data is adequately protected and that data handling complies with applicable data protection regulations. Transparent privacy policies and clearly defined opt-in processes are key to gaining customer trust.

Banks should invest in technologies and processes that ensure the protection of customer data, such as strong encryption, access controls and security monitoring systems. According to our research, around 85 percent of banks see the security and protection of customer data as the most important criterion for maintaining customer confidence and remaining competitive.

IV. Consileon’s Holistic Approach to Improve Customer Experience with AI

Successful integration of AI requires careful preparation and a mindset shift. Banks need to recognise that AI projects involve not only technological aspects, but also organisational and cultural changes.

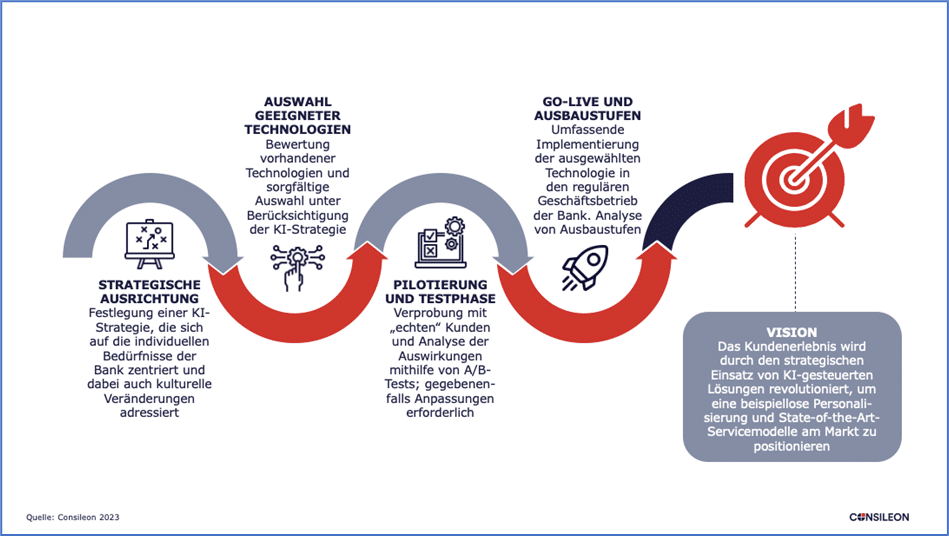

A holistic approach is essential in order to integrate meaningful and connected solutions into everyday banking. To effectively implement AI, banks should consider the following multi-level aspects.

Strategic focus: A clear strategic focus must define how AI is to be used to improve the customer experience. Banks need to identify their objectives and priorities and ensure that AI projects support them. A comprehensive AI strategy focusing on the Bank’s specific needs and objectives is a key prerequisite for the implementation of such projects.

Selection and definition of suitable technologies: The clearly defined business goals are followed by the consistent selection of the right AI technology(s). This depends to a large extent on the specific requirements of the project, with factors such as data availability, complexity of the infrastructure and the legal implementation framework playing a key role. The necessary expertise must be available to evaluate the different AI solutions and select the ones that best fit the bank’s business model.

Pilot and test phase: The selected AI solution is tested and validated on a limited scale before being implemented on a wider scale. During piloting, customer interactions in the selected system are monitored; feedback is collected to ensure that the tested technology can meet the strategic objectives. In this phase, the AI is adapted to maximize performance and customer experience before the solution is implemented in the bank’s regular operations (go-live).

V. Summary

Using AI to improve the customer experience provides banks and financial services providers with a variety of benefits, including personalized customer offerings, proactive customer service, and the efficient automation of processes. By using AI-powered chatbots, virtual transcription assistants, and fraud prevention algorithms, banks can increase customer satisfaction and improve the customer experience.

To successfully deploy these technologies, banks need to develop an AI strategy and define clear objectives. An appropriate IT infrastructure, effective data management and compliance with data protection are fundamental prerequisites. Banks also need to have the necessary expertise and resources.

The implementation of technology/AI projects offers banks the opportunity to individualize their services, strengthen customer relationships and thus generate competitive advantages. With the right planning and implementation, banks can unlock the full potential of AI and deliver innovative solutions to their customers. Taking these aspects into account is already critical to success. Bank customers are increasingly familiar with modern technologies and expect their banks to offer corresponding solutions.

Consileon is happy to help you define and develop an AI strategy to improve the customer experience and help you create the necessary conditions. We accompany you throughout the entire process and also support you in the implementation of the solution in order to achieve optimal results through a holistic consultation.

Do not hesitate to contact us for an initial consultation.

Quellen: [1] Bundesministerium für Wirtschaft und Finanzen, “KI-Startups in Deutschland 2022“, Consileon Research 2023; [2] Juniper Research,” Chatbots, a Game Changer for Banking & Healthcare, saving 8$ billion Annually by 2022.”, Consileon Research 2023; [3] Finovate, “Five GPT3 Use cases for Banks and Fintechs.”; [4] J. Zhong & W. Li, “Predicting Customer Churn in the Telecommunication Industry by Analyzing Phone Call Transcripts with Convolutional Neural Networks.”; [5] Unique FinanceGPT, “An AI Tool For Client Advisors”; [6] Der Bank Blog, “Kunden wollen personalisierte Finanzprodukte“; [7] IBS Intelligence, „Nordea adopts AI chatbot strategy to scale customer service.”; [8] Statista 2023; [9] IT-Finanzmagazin, “Künstliche Intelligenz verhindert Milliardenbetrug“; [10] Der Bank Blog, “Fünf Anwendungsfälle für RPA“